Basis of corporate taxes in Europe

The tax system in Europe varies from country to country as each country has its own set of tax laws and regulations. However, there are some similarities in the kind of taxes commonly found in many European countries. The most common types of taxes faced by companies include the following:

1. 📊Corporate income tax

Corporate income tax is the main tax levied on the profits made by companies after allowing for permitted expenses. Each country sets its own corporate income tax rate, with some having high rates in order to collect more taxes while others offer low rates to encourage foreign investment. This tax is one of the biggest concerns for companies when determining where to set up.

2. 🏫Local and municipal taxes

In addition to national taxes, companies often face local taxes that serve to finance the budgets of local administrations.

3. 💸Payroll taxes

Companies in Europe are subject to payroll taxes that include compulsory social security contributions and other contributions, such as unemployment insurance or pensions. These taxes are usually divided between the company and the employees and their purpose is to finance the countries' social welfare systems.

4. 🔑Property tax

Companies that own real estate are generally required to pay taxes on these assets. This tax is generally calculated based on the cadastral value of the property, its location and use.

5. 📤Transfer tax

Transactions related to the purchase or sale of property, business assets or shares may be subject to a capital transfer tax. This tax is applied as a percentage of the value of the transaction and varies depending on the type of asset and the country.

6. ♻️Environmental taxes

In many European countries, companies must pay specific taxes related to the environmental impact of their activities in order to encourage more sustainable business practices.

7. 🛃Customs duties

Companies that import goods from outside the European Union must pay tariffs and import taxes. These taxes depend on the type of product and its origin and are designed to protect local production and raise revenue.

Expert Accounting Help | EasyBiz

Payroll services and accounting from €90. Expert team ready to help.

Learn moreEuropean tax comparison and countries with the lowest corporate taxes

As we have seen in the previous section, there are a large number of tax categories, which makes it extremely complicated to classify countries according to their level of taxation. A country may have low corporate and local taxes but at the same time have high property taxes and taxes on capital gains. A first starting point for a comparative analysis would be to examine the categories separately and since the corporate tax category is one of the most important, this article will focus on that.

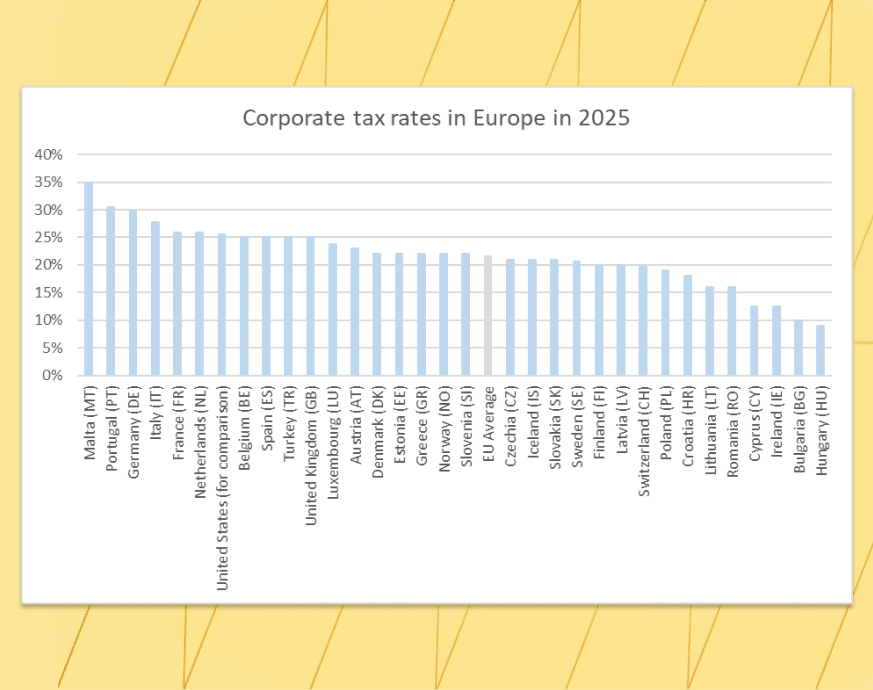

Below is a graph based on Tax Foundation data that shows comparative corporation tax levels in Europe in 2025. It reveals that the highest taxes are in Malta, Portugal, Germany, Italy and France, while the lowest are in Romania, Cyprus, Ireland, Bulgaria and finally Hungary at the bottom of the list with the lowest tax rate. The European average is 21.5%, leaving eighteen countries above and fifteen below.

Source: Tax Foundation

In the following sections, we will briefly examine the taxation of companies in some of these countries that stand out for their low corporate taxes.

Hungary

Hungary has the cheapest corporate tax in Europe thanks to the far-reaching tax reforms undertaken by the Hungarian government in recent years. The main changes implemented include an aggressive reduction in the general rate of corporate tax and the widespread introduction of a flat rate as a single withholding scale for income tax. These new tax rates have made Hungary a highly attractive destination and have encouraged economic growth.

Before the reform that came into force in 2017, the country applied a double tax system, with a scale of 10% for the first 1.7 million euros of profit and another of 19% for profits received above that threshold. Since the reform came into force, the new system simply requires a payment of 9% of the profits obtained at the end of the financial year.

In contrast to these low taxes in Hungary, VAT amounts to 27% of the taxable base of the product or service acquired, one of the highest if not the highest in Europe.

Bulgaria

Since January 1, 2007, the single rate of corporation tax in Bulgaria is 10%, replacing the previous rate of 15%, making it one of the lowest corporation tax rates in Europe, just behind Hungary. This low rate, combined with low labor costs, has made the country a very attractive alternative for foreign investment.

Another point to highlight is that in Bulgaria there is no special tax on capital gains, these gains form part of a company's profits and are taxed at the general corporate tax rate.

Ireland

Another EU country with one of the lowest corporate taxes is Ireland. The single rate of corporation tax of 12.5% makes this country an extremely favorable environment for companies, which has helped it to attract a large number of international companies, including technology companies such as Apple, Google and META. This attractiveness is also compounded by the fact that Ireland is one of the few English-speaking countries in the European Union, along with Malta, following the departure of the United Kingdom.

As well as offering low tax rates, Ireland offers attractive tax credits for research and development expenses, such as a net tax exemption for companies of 37.5%. However, recent decisions by members of the Organization for Economic Co-operation and Development (OECD) are expected to result in an increase in Ireland's corporate tax rate to a minimum of 15%.

Cyprus

Cyprus is one of the EU countries with the lowest taxes for companies, with a rate of 12.5%, the same as Ireland. However, this is not the only favorable aspect of its tax system. If the company produces products that can be classified as intellectual property, this tax rate is reduced to 2.5%. Additionally, Cyprus' income tax law explicitly provides for a series of exemptions for many and varied types of income, benefits and profits. And to top it all off, there are no local income taxes in Cyprus.

Romania

Towards the end of the analysis of the lowest corporate income tax rates in Europe, Romania comes in with a corporate tax rate of 16%, slightly above Cyprus and Ireland but still below the European average of 21.5%.

Besides this, the country offers particularly low tax rates for micro-enterprises, which only have to pay a corporate tax of 1% on the first 60,000 euros and 3% on the rest up to 500,000 euros. If the figure exceeds half a million, the general rate of 16% will be applied from the following quarter.

Lithuania

To finish, Lithuania has a 16% tax for companies, the same as Romania, after the 1% increase in its rates that took place on January 1, 2025. In addition to the standard rate, there are reduced rates for certain types of companies:

- Small businesses and agricultural businesses that meet certain criteria may benefit from a reduced rate of 6%.

- Small companies that meet specific criteria may apply a 0% rate during their first year of activity.

- For credit institutions, an increased rate of 21% (16% plus an additional 5%) is applied to taxable profits in excess of 2 million euros.

It is also worth noting that there is no local or municipal corporate income tax in Lithuania.