Why invest in Luxembourg? An overview for 2025

When considering smart places to invest in 2025, Luxembourg may not be the first country that comes to mind, but for those who know, this small country is a top-tier investment spot. If you’re planning or just dreaming of launching your own business or building your wealth, Luxembourg has a lot to offer investors looking for strong returns.

Why Luxembourg?

Luxembourg is a global financial centre that continues to lead in such spheres as investment and innovation. Today it remains a top-choice destination for investors and business owners, and here are a few insights why.

Economic stability and growth

Luxembourg’s economy consistently ranks among the most stable in Europe, with strong growth projections and top-tier credit ratings (AAA across the board). The country stood strong through economic ups and downs better than most, thanks to its smart financial policies and diversified economy.

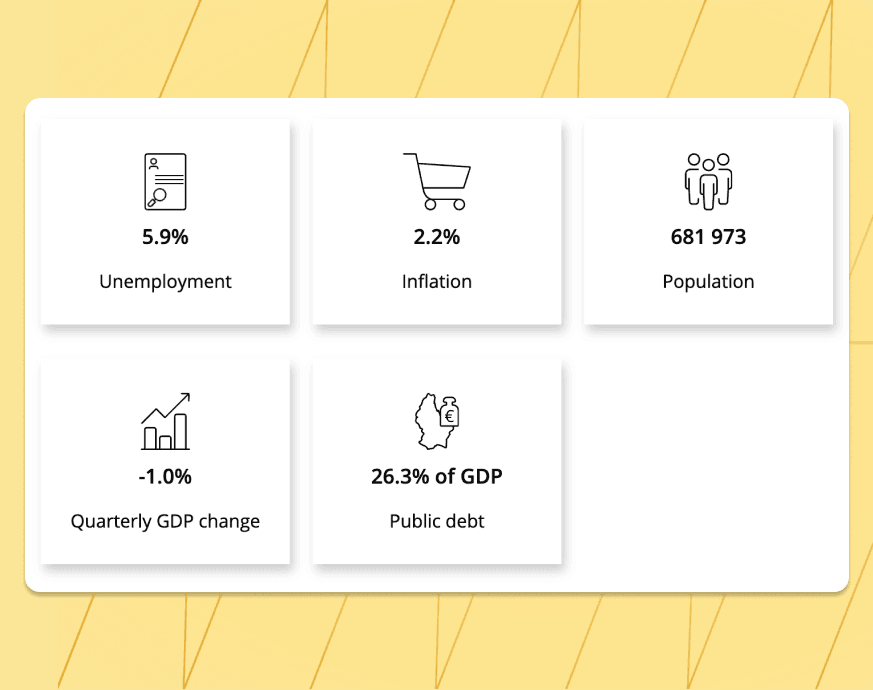

Key Economic Indicators for Luxembourg (2025 Projections)

The Luxembourgish Statistics Portal gives us a few hints with numbers on the current economic situation.

(Source: STATEC)

Regarding the 2025 forecast, the numbers are also quite favourable, making Luxembourg a reliable investment destination:

| Indicator | 2025 Forecast |

| GDP Growth | ~1.0% – 1.7% |

| Inflation Rate | 1.9% – 2.1% |

| Unemployment Rate | 6.6% |

| Gross Public Debt (% of GDP) | 25.7% |

(Sources: STATEC, European Commission)

Favourable regulatory and legal framework

Investing feels safer in Luxembourg, since the Commission de Surveillance du Secteur Financier (CSSF) is the national regulator responsible for keeping the financial sector secure and well-managed.

There were several investor protection laws updated in 2025 to reflect new technologies and digital investment methods, giving you even more legal certainty. Your assets are well-protected, and the rules are clear, which is a big plus for both first-time and seasoned investors.

Gateway to European and international markets

Luxembourg sits at the heart of Europe, being perfectly positioned as a gateway for cross-border investments with easy access to the EU market and beyond. The country also has over 80 double taxation treaties, making it easier (and cheaper) for international investors to manage their portfolios across borders.

How to invest money in Luxembourg

Let’s look at how to invest your money in Luxembourg, if you’ve been convinced enough. There’s always something for every type of investor out there.

Investment funds (UCITS and AIFs)

Luxembourg is the world’s second-largest investment fund centre, right after the US, so If you’re looking for smart-managed funds, this is the right place.

- UCITS (Undertakings for Collective Investment in Transferable Securities): well-regulated, easy-to-sell funds ideal for retail investors, great for beginners.

- AIFs (Alternative Investment Funds): include hedge funds, real estate funds, and private equity funds, usually for experienced investors or institutions.

| Fund Type | Target Investor | Risk Level | Liquidity | Regulated by |

| UCITS | Retail (general public) | Medium | High | CSSF |

| AIFs | Professional/wealthy | Varies | Low–Medium | CSSF |

Real Estate Investment

Real estate in Luxembourg remains a strong performer no matter the type. From residential flats in Luxembourg City to commercial properties in the growing logistics sector, good returns can definitely be made.

- Rental yields for residential properties average around 3–4%.

- Commercial real estate (especially office and logistics space) offers yields of 5–6%, depending on location.

- Areas such as Esch-sur-Alzette and Belval are experiencing increasing interest due to urban development and high demand.

Check out more information on commercial real estate trends and see if this one suits your case.

Capital markets (stocks and bonds)

You can also invest directly in companies through the Luxembourg Stock Exchange (LuxSE). It is transparent and high-tech, with a focus on sustainable investing.

- Popular sectors include finance, technology, and renewable energy.

- Luxembourg is also a leader in the green bond market.

Example strategy: a diversified portfolio with 60% LuxSE-listed ETFs, 30% green bonds, and 10% tech stocks. This combo has shown stable annual growth over the past 3 years.

Private Equity and Venture Capital

This option is higher risk, but its goal is bigger growth. Luxembourg’s private equity and VC scene is booming, and there are different places to look for investors to support startups.

- 🔥 FinTech, Space, and HealthTech are the hot sectors in 2025.

- The government offers support for innovation through initiatives like the Luxembourg Future Fund and Fit 4 Start, which help startups and early-stage investors get going.

You can dive deeper and find more info about AI startups in Luxembourg or women-led startups based in Luxembourg for inspiration.

Navigating the investment process

Once you’ve decided that Luxembourg is the place you want to invest in, there are a few steps you need to take.

Opening an Investment Account

No matter if you're investing as an individual or through a company, you’ll need to open an account with a local bank or licensed investment firm.

What you’ll need:

- ✔ Valid ID or passport

- ✔ Proof of address

- ✔ Tax identification number

- ✔ Source of funds documentation (for KYC)

- ✔ Corporate registration documents (for businesses)

Don’t forget that KYC (Know Your Customer) and AML (Anti-Money Laundering) checks are strictly enforced in Luxembourg, as it’s all about maintaining a clean and secure system.

Tax considerations for investors

Luxembourg offers a friendly tax environment, especially for international investors, but there are still a few things to keep in mind:

- Capital gains tax: generally low for long-term investments.

- Withholding tax: often reduced or eliminated thanks to double tax treaties.

- Wealth tax: only applies to certain types of corporate structures.

There are also tax incentives for sustainable and startup investments. Being a business that invests in digital transformation projects in Luxembourg can even make you eligible for specific tax relief. So pick your niche and invest away!

Seeking professional advice

Certainly, navigating international investments can be pretty challenging. That’s why it’s worth talking to experts who can help:

- Financial advisors (for strategy and asset allocation)

- Tax consultants (to keep things efficient)

- Legal professionals (especially for business setup or real estate)

Expert Accounting Help | EasyBiz

Payroll services and accounting from €90. Expert team ready to help.

Learn moreThe right team can help you make smarter and more secure choices from planning to building your financial future.

Conclusion

Luxembourg is set to maintain its status as a premier investment hub in 2025, driven by a robust economy, leading financial services sector, and excellent access to global markets. Investors at any stage will find a secure and adaptable environment here — from investment funds and real estate to burgeoning startups and the stock market.